Table of Contents

- Sandstone Point Hotel Map 2024 Map - Edee Nertie

- 2024 Topps Chrome Update Checklist Printable - Miran Anallise

- Essential Tax Return Checklist 2024 Excel Template And Google Sheets ...

- "The Ultimate 2024 Tax Filing Checklist For A Seamless Process" Excel ...

- Tax Prep Documents Checklist from H&R Block - Worksheets Library

- Partidos De Eliminatorias Sudamericanas 2025 - Edee Nertie - group ...

- 2024 Es 2024 Payment Dates And Times - Edee Nertie

- Efficient Checklist For Tax Preparation 2024 Excel Template And Google ...

- Income Tax Prep Checklist Free Printable Checklist Tax Prep | Hot Sex ...

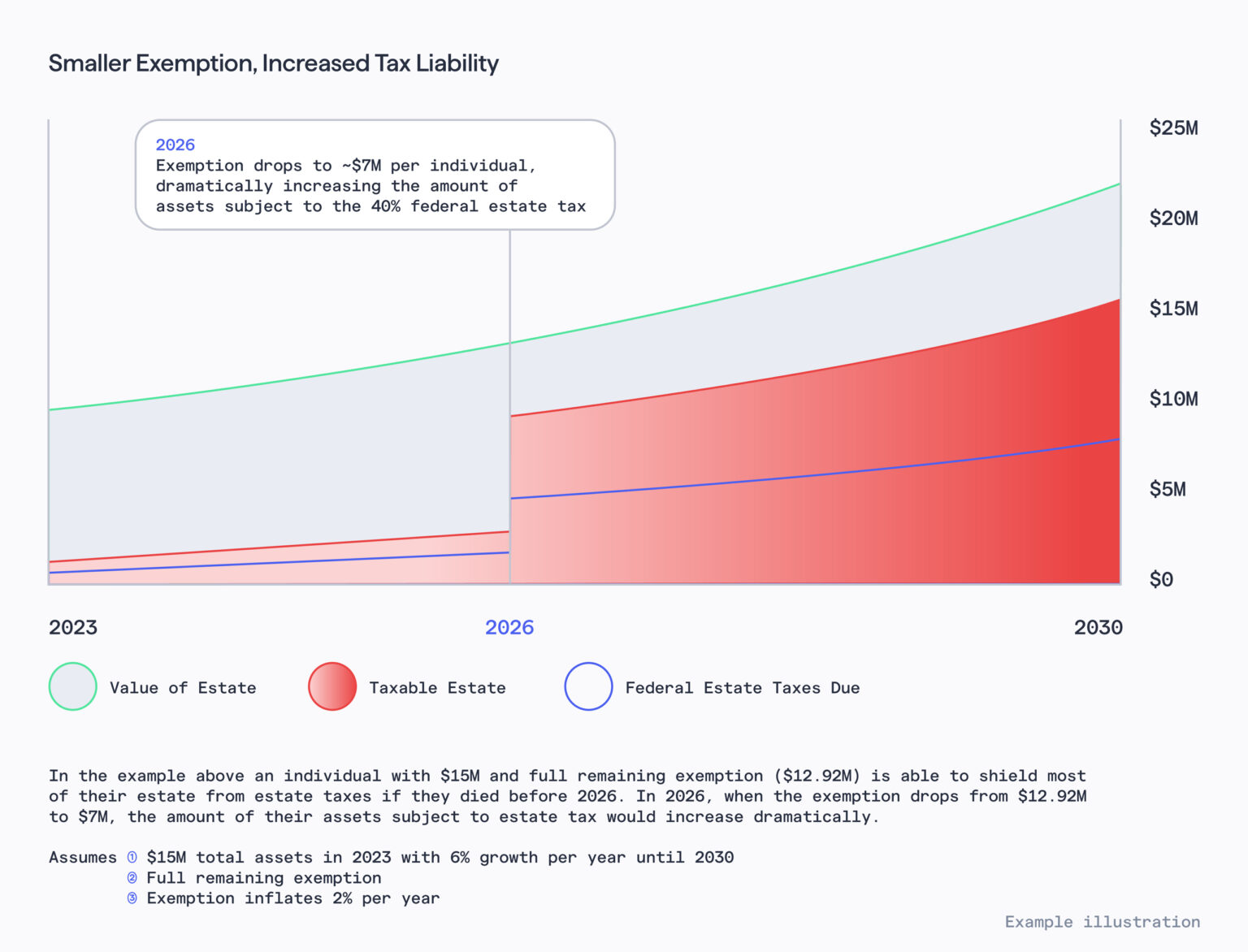

- The 2026 estate tax exemption sunset is coming. Here’s what you need to ...

Understanding IRS Tax Forms

State Tax Forms

e-Filing: The Convenient Way to File Your Taxes

Electronic filing, or e-filing, has revolutionized the tax filing process. With e-filing, taxpayers can submit their tax returns online, reducing the risk of errors and expediting the refund process. To e-file your taxes, you'll need to: Gather required documents: Collect all necessary tax forms, including W-2s, 1099s, and receipts for deductions Choose an e-filing platform: Select a reputable e-filing service, such as TurboTax or H&R Block Follow the e-filing process: Complete the online tax return, review, and submit your return

Benefits of e-Filing

e-Filing offers numerous benefits, including: Convenience: File your taxes from the comfort of your own home, 24/7 Accuracy: Reduce the risk of errors with automated calculations and built-in checks Speed: Receive your refund faster, often within a few weeks of filing Security: Enjoy enhanced security features, including encryption and secure servers Filing your taxes can be a daunting task, but with the right guidance, it doesn't have to be. By understanding the different IRS and state tax forms required for tax year 2026, and taking advantage of e-filing, you can streamline your tax filing process and enjoy a faster, more convenient experience. Remember to gather all necessary documents, choose a reputable e-filing platform, and follow the e-filing process to ensure a smooth and successful tax filing experience.By following these steps and staying informed about tax laws and regulations, you'll be well on your way to a stress-free tax season. So why wait? Start preparing for tax year 2026 today, and discover the benefits of e-filing for yourself.